Difference between revisions of "Robert Fleming & Co."

(→An "enigma") |

(→An "enigma": Military and intelligence links) |

||

| (39 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | + | '''Robert Fleming & Co.''' was a London-based asset manager and merchant bank founded in 1873<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010</ref> and sold to [[Chase Manhattan Bank]]<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010</ref> for over $7 billion in April 2000.<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Bloomberg Business Week, undated, acc 30 Mar 2010</ref><ref>[http://www.independent.co.uk/news/business/news/chase-in-pound77bn--fleming-bid-719470.html Chase in £7.7bn Fleming bid], The Independent, 11 April 2000, acc 29 Mar 2010</ref><ref>Marc Sousley, [http://www.efinancialnews.com/story/2000-04-11/chase-lands-fleming-for Chase lands Fleming for $7.7bn], Financial News, 11 Apr 2000, acc 30 Mar 2010</ref> At the time of the sale it had a controlling interest in the highly successful Asian investment bank [[Jardine Fleming]]. It also had 7,800 employees and operations in 44 countries.<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Bloomberg Business Week, undated, acc 30 Mar 2010</ref><ref>Marc Sousley, [http://www.efinancialnews.com/story/2000-04-11/chase-lands-fleming-for Chase lands Fleming for $7.7bn], Financial News, 11 Apr 2000, acc 30 Mar 2010</ref> | |

| − | '''Robert Fleming & Co.''' was a London based asset manager and merchant bank founded in 1873<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010</ref> and sold to [[Chase Manhattan Bank]]<ref>[http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=677590 Robert Fleming Holdings Limited], Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010</ref> for over $7 billion in 2000.<ref>[http://www.independent.co.uk/news/business/news/chase-in-pound77bn--fleming-bid-719470.html Chase in £7.7bn Fleming bid], The Independent, 11 April 2000, acc 29 Mar 2010</ref> | ||

==History== | ==History== | ||

| − | The firm of Robert Fleming & Co., known as Flemings, was founded in Dundee, Scotland in 1873 by [[Robert Fleming (financier)|Robert Fleming]], a successful manufacturer of jute fabrics used for sandbags in the American Civil War. | + | The firm of Robert Fleming & Co., known as Flemings, was founded in Dundee, Scotland in 1873 by [[Robert Fleming (financier)|Robert Fleming]], a successful manufacturer of jute fabrics used for sandbags in the American Civil War. The firm was originally formed as a series of investment trust, pooling money from Scottish investors into overseas ventures, and later moved into merchant banking. In 1900 the firm moved to London.<ref>Jane Lewis, [http://www.moneyweek.com/news-and-charts/profile-the-flemings.aspx Profile: The Flemings], MoneyWeek, 21 Dec 2005, acc 30 Mar 2010</ref> |

===Relationship with Jardine Matheson=== | ===Relationship with Jardine Matheson=== | ||

| − | In 1970, Flemings entered into an investment banking joint venture with Hong Kong-based [[Jardine Matheson]], forming [[Jardine Fleming]]. The tie-up was prompted by the long-standing family links between the Flemings and the [[William Keswick|Keswick family]] of Scotland, who have run Jardine Matheson since its founding. | + | In 1970, Flemings entered into an investment banking joint venture with Hong Kong-based [[Jardine Matheson]], forming [[Jardine Fleming]]. The tie-up was prompted by the long-standing family links between the Flemings and the [[William Keswick|Keswick family]] of Scotland, who have run Jardine Matheson since its founding.<ref>Jane Lewis, [http://www.moneyweek.com/news-and-charts/profile-the-flemings.aspx Profile: The Flemings], MoneyWeek, 21 Dec 2005, acc 30 Mar 2010</ref> |

| − | ===An "enigma"=== | + | ===An "enigma": Military and intelligence links=== |

| − | :For the best part of a century, Robert Fleming & Co remained in the investment trust business, says the FT. Although it later moved into merchant banking, "it differed radically from other merchant banks", where banking was the core business. Privately held throughout its existence, Flemings was always "something of an enigma". The group published little information about itself and questions about strategy "met with the quizzical look of the classic British amateur". But although it remained old-school in style, it was the "boldest and most far-sighted of any institution in the Square Mile". Connections helped: the 1970 Jardine Fleming Hong Kong venture, which established the group in the Far East long before competitors got there, was prompted by the long-standing family links between the Flemings and the Keswicks, who run Jardine Matheson.<ref>[http://www.moneyweek.com/file/5899/profile-1612.html Profile: The Flemings] Moneyweek, | + | An article in MoneyWeek describes the history of Robert Fleming & Co.: |

| + | :For the best part of a century, Robert Fleming & Co remained in the investment trust business, says the FT. Although it later moved into merchant banking, "it differed radically from other merchant banks", where banking was the core business. Privately held throughout its existence, Flemings was always "something of an enigma". The group published little information about itself and questions about strategy "met with the quizzical look of the classic British amateur". But although it remained old-school in style, it was the "boldest and most far-sighted of any institution in the Square Mile". Connections helped: the 1970 Jardine Fleming Hong Kong venture, which established the group in the Far East long before competitors got there, was prompted by the long-standing family links between the Flemings and the Keswicks, who run Jardine Matheson.<ref>Jane Lewis, [http://www.moneyweek.com/file/5899/profile-1612.html Profile: The Flemings] Moneyweek, Dec 21, 2005, acc 30 Mar 2010</ref> | ||

| − | Another sense in which the bank was an 'enigma' is that it had | + | Another sense in which the bank was an 'enigma' is that it had strong associations with the British military, including special forces, as well as with the intelligence services. In 1992 [[Peter de la Billiere]], former commander in chief of the [[SAS]] and then [[UK Special Forces]], and commander of the British land forces in the Gulf war, was appointed a non-executive director of Robert Fleming & Co., a post he retained for seven years.<ref>Topaz Amoore, [http://www.independent.co.uk/news/business/column-eight-bridging-the-gulf-at-fleming-1533405.html?cmp=ilc-n Column Eight: Bridging the gulf at Fleming], The Independent, 15 Jul 1992, acc 30 March 2010</ref><ref>Higher colleges of Technology [http://apps.hct.ac.ae/fot2009/thinkerDetails.aspx?un=32&spkrName=Sir%20Peter%20de%20la%20%20Billiere Sir Peter de la Billiere], Dubai, acc 30 Mar 2010</ref> [[Rupert Wise]], described in the ''Daily Telegraph'' as 'The banker with a CV out of a spy novel'<ref>Ben Fenton '[http://www.telegraph.co.uk/news/worldnews/middleeast/iran/1502810/The-banker-with-a-CV-out-of-a-spy-novel.html The banker with a CV out of a spy novel]' ''Daily Telegraph'' 12/11/2005, accessed 28 March 2010</ref> became managing director of its Middle East division in around 1984; and [[Mark Bullough]], who went on to co-found the mercenary company [[Aegis Defence Services]] with Lt Col [[Tim Spicer]], worked at Robert Fleming & Co. for 20 years.<ref>[http://www.aegisworld.com/management.html Management Information - AEGIS private security company], accessed 13 April 2008.</ref> [[Dominic Armstrong]] was Bullough’s deputy at [[Jardine Fleming]], the subsidiary of Robert Fleming and Co. in Malaysia.<ref>[http://books.google.co.uk/books?id=Lz1PIfuk2HsC&pg=PA279&lpg=PA279&dq=%22dominic+armstrong%22+fleming+bullough&source=bl&ots=5nIq9G9nMf&sig=w4JSZmMNPe-MmyuAUezcXX3hCUw&hl=en&ei=OLCxS_UrkojTBLuHwLcE&sa=X&oi=book_result&ct=result&resnum=8&ved=0CBwQ6AEwBw#v=onepage&q=%22dominic%20armstrong%22%20fleming%20bullough&f=false Malaysia Business Law Handbook], Washington DC: USA International Business Publications, [http://www.spinprofiles.org/index.php/Image:Malaysia_Business_Law_Handbook_-_Google_Books_1269936280395.png Screengrab], accessed 30 March 2010</ref> Bullough and Tim Spicer had been comrades in the Scots Guards and had fought together in the Falklands. Both Spicer and [[Simon Mann]], the mercenary jailed for his part in the failed coup in Equatorial Guinea, and de la Billiere had also worked closely together. So Flemings looks like a bolthole or temporary perch for intelligence connected/special forces people. |

| − | == | + | One person who apparently does not fit this description is the BBC journalist [[Frank Gardner]], who took over the Bahrain office of the bank after [[Rupert Wise]] and worked in the post 1986-95.<ref>[http://news.bbc.co.uk/1/hi/uk/3782655.stm Profile: Frank Gardner], BBC News, 7 Jun 04, acc 30 Mar 2010</ref> Gardner has publicly stated that he rejected an invitation to join MI6 before he graduated from Exeter University.<ref>David Rowan, [http://www.thefreelibrary.com/Shot+six+times,+but+I+won%27t+be+silenced%3B+BBC+correspondent+Frank...-a0133259526 Shot six times, but I won't be silenced; BBC correspondent Frank Gardner, just awarded an OBE, warns that the media must keep the terror threat in perspective], The Evening Standard, Jun 15 2005, acc 30 Mar 2010</ref> |

| + | |||

| + | The right wing historian [[Andrew Roberts]] also reportedly turned down an MI6 recruitment attempt. While at Cambridge, Roberts was approached to join the 'FCO Co-ordinating Staff', a euphemism for [MI6]. He went through the selection process, but decided not to join. <ref> MI6: Inside the Covert World of Her Majesty's Secret Intelligence Service, by Stephen Dorril, Touchstone, 2002, p.783. </ref> He later joined Flemings too.<ref>Christopher Monckton, ''The Aids Report: An examination of public health policy on AIDS'', London: [[Policy Search]], 14 [[Tufton Street]], Westminster, SW1, May 1987.</ref> | ||

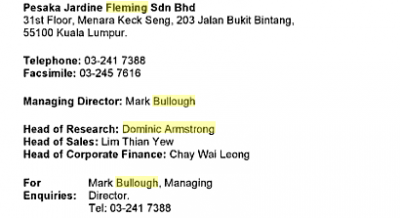

| + | [[Image:Malaysia Business Law Handbook - Google Books 1269936280395.png|thumb|right|400px|Screengrab showing the [[Mark Bullough]] and [[Dominic Armstrong]] worked together at [[Jardine Fleming]] in Malaysia.<ref>[http://books.google.co.uk/books?id=Lz1PIfuk2HsC&pg=PA279&lpg=PA279&dq=%22dominic+armstrong%22+fleming+bullough&source=bl&ots=5nIq9G9nMf&sig=w4JSZmMNPe-MmyuAUezcXX3hCUw&hl=en&ei=OLCxS_UrkojTBLuHwLcE&sa=X&oi=book_result&ct=result&resnum=8&ved=0CBwQ6AEwBw#v=onepage&q=%22dominic%20armstrong%22%20fleming%20bullough&f=false Malaysia Business Law Handbook], Washington DC: USA International Business Publications, p. 280</ref>]] | ||

| + | |||

| + | A famous scion of the Fleming family with intelligence links was [[Ian Fleming]], the author of the James Bond novels, who was the grandson of Robert Fleming, the founder of Robert Fleming & Co. Before his novel-writing career, Ian Fleming worked as a journalist and spy for the [[Foreign Office]].<ref>John Cork, [http://www.klast.net/bond/flem_bio.html The Life of Ian Fleming (1908-1964)], 1995, acc 30 Mar 2010</ref> | ||

| + | |||

| + | ==Decline== | ||

In 1997, Robert Fleming Holdings had operations in 44 countries in Asia, Eastern Europe, the Americas and Africa. Its net assets as for the 1997 fiscal year were £841 million and its profit before tax for the year was £136.1 million. Its global asset management business managed £63 billion on behalf of institutional and private investors around the world. These results included Jardine Fleming, which in its own right had operations in 15 countries in the Asia-Pacific region, seats on 20 stock exchanges and some US$19.7 billion in funds under management. Jardine Fleming’s profit before tax for the year was US$41.4 million.<ref> http://www.irasia.com/listco/sg/jm/press/p981203.htm| Fleming Holdings press release, Dec. 3, 1998.</ref> The firm’s significant transactions included the privatization of state-owned Pakistan Telecommunication Co. Ltd. in 1994. | In 1997, Robert Fleming Holdings had operations in 44 countries in Asia, Eastern Europe, the Americas and Africa. Its net assets as for the 1997 fiscal year were £841 million and its profit before tax for the year was £136.1 million. Its global asset management business managed £63 billion on behalf of institutional and private investors around the world. These results included Jardine Fleming, which in its own right had operations in 15 countries in the Asia-Pacific region, seats on 20 stock exchanges and some US$19.7 billion in funds under management. Jardine Fleming’s profit before tax for the year was US$41.4 million.<ref> http://www.irasia.com/listco/sg/jm/press/p981203.htm| Fleming Holdings press release, Dec. 3, 1998.</ref> The firm’s significant transactions included the privatization of state-owned Pakistan Telecommunication Co. Ltd. in 1994. | ||

| Line 20: | Line 27: | ||

===Scandal, crisis and restructuring=== | ===Scandal, crisis and restructuring=== | ||

| − | The Fleming name was tarnished by a scandal in 1996, when Jardine Fleming was ordered to pay $19 million to fund investors for alleged abusive and unsupervised securities allocation practices by asset management head Colin Armstrong. The 1997 Asian crisis severely hit both Robert Fleming and Jardine Fleming. Robert Fleming was forced to approve massive lay offs in late 1998. The firm restructured in 1999, buying the remaining 50% stake in Jardine | + | The Fleming name was tarnished by a scandal in 1996, when Jardine Fleming was ordered to pay $19 million to fund investors for alleged abusive and unsupervised securities allocation practices by asset management head Colin Armstrong. The 1997 Asian crisis severely hit both Robert Fleming and Jardine Fleming. Robert Fleming was forced to approve massive lay offs in late 1998. The firm restructured in 1999, buying the remaining 50% stake in Jardine Fleming in return for giving Jardine Matheson an 18% stake in Robert Flemings Holdings.<ref>Garfield, Andrew, [http://www.faqs.org/abstracts/Retail-industry/Fleming-cements-ties-with-Keswicks-Dragging-Lazards-into-the-21st-century.html Fleming cements ties with Keswicks], The Independent, 4 December 1998, acc 30 Mar 2010</ref> However, despite these efforts, Flemings continued to see its investment banking and asset management market share decline as global investment banks like [[Morgan Stanley]] and [[Lazard]] moved into their markets.<ref>Garfield, Andrew, [http://www.faqs.org/abstracts/Retail-industry/Fleming-cements-ties-with-Keswicks-Dragging-Lazards-into-the-21st-century.html Fleming cements ties with Keswicks], The Independent, 4 December 1998, acc 30 Mar 2010</ref> |

===Sale to Chase=== | ===Sale to Chase=== | ||

| − | In April 2000, Robert Fleming Holdings was sold to [[Chase Manhattan Bank]] for $7.7 billion (then £4.5 million).<ref>[http://www.independent.co.uk/news/business/news/chase-in-pound77bn--fleming-bid-719470.html Chase in £7.7bn Fleming bid], The Independent, 11 April 2000, acc 29 Mar 2010</ref> Although the sale came about as partially as a result of Fleming's weakened position, it was part of two larger trends: consolidation in the financial services industry as large U.S. commercial banks acquired investment banks upon the repeal of the [[Glass-Steagall Act]], and the sale of UK merchant banks to foreign banks. Flemings, with almost no US assets, was considered a particularly good fit for increasingly globally-minded Chase, whose assets lay largely in the United States. In the sale about 130 Fleming family members pocketed approximately $2.3 billion for their 30% stake. | + | In April 2000, Robert Fleming Holdings was sold to [[Chase Manhattan Bank]] for $7.7 billion (then £4.5 million).<ref>[http://www.independent.co.uk/news/business/news/chase-in-pound77bn--fleming-bid-719470.html Chase in £7.7bn Fleming bid], The Independent, 11 April 2000, acc 29 Mar 2010</ref> Although the sale came about as partially as a result of Fleming's weakened position, it was part of two larger trends: consolidation in the financial services industry as large U.S. commercial banks acquired investment banks upon the repeal of the [[Glass-Steagall Act]], and the sale of UK merchant banks to foreign banks. Flemings, with almost no US assets, was considered a particularly good fit for increasingly globally-minded Chase, whose assets lay largely in the United States. In the sale about 130 Fleming family members pocketed approximately $2.3 billion for their 30% stake. When Chase merged with [[JP Morgan]] in 2002, the Fleming asset management business was rebranded J.P. Morgan Fleming. |

===After 2000=== | ===After 2000=== | ||

| Line 29: | Line 36: | ||

==People== | ==People== | ||

| − | *[[Peter de la Billiere]] | [[Mark Bullough]] | [[Frank Gardner]] | [[Andrew Roberts]] | [[Alan Sutherland]] | | + | *[[Peter de la Billiere]] | [[Mark Bullough]] | [[Frank Gardner]] | [[Andrew Roberts]] | [[Timothy Steel]]'joined [[Cazenove]] in 1980 from [[Robert Fleming and Co|Robert Fleming]]'<ref>[[Media:Committed Capital - Tim Steel.pdf|PDF Copy]] of <www.committedcapital.co.uk/team/advisory-board/tim-steel> created 27 April 2010.</ref> | [[Alan Sutherland]] | |

==Affiliations== | ==Affiliations== | ||

Latest revision as of 20:07, 27 April 2010

Robert Fleming & Co. was a London-based asset manager and merchant bank founded in 1873[1] and sold to Chase Manhattan Bank[2] for over $7 billion in April 2000.[3][4][5] At the time of the sale it had a controlling interest in the highly successful Asian investment bank Jardine Fleming. It also had 7,800 employees and operations in 44 countries.[6][7]

Contents

History

The firm of Robert Fleming & Co., known as Flemings, was founded in Dundee, Scotland in 1873 by Robert Fleming, a successful manufacturer of jute fabrics used for sandbags in the American Civil War. The firm was originally formed as a series of investment trust, pooling money from Scottish investors into overseas ventures, and later moved into merchant banking. In 1900 the firm moved to London.[8]

Relationship with Jardine Matheson

In 1970, Flemings entered into an investment banking joint venture with Hong Kong-based Jardine Matheson, forming Jardine Fleming. The tie-up was prompted by the long-standing family links between the Flemings and the Keswick family of Scotland, who have run Jardine Matheson since its founding.[9]

An "enigma": Military and intelligence links

An article in MoneyWeek describes the history of Robert Fleming & Co.:

- For the best part of a century, Robert Fleming & Co remained in the investment trust business, says the FT. Although it later moved into merchant banking, "it differed radically from other merchant banks", where banking was the core business. Privately held throughout its existence, Flemings was always "something of an enigma". The group published little information about itself and questions about strategy "met with the quizzical look of the classic British amateur". But although it remained old-school in style, it was the "boldest and most far-sighted of any institution in the Square Mile". Connections helped: the 1970 Jardine Fleming Hong Kong venture, which established the group in the Far East long before competitors got there, was prompted by the long-standing family links between the Flemings and the Keswicks, who run Jardine Matheson.[10]

Another sense in which the bank was an 'enigma' is that it had strong associations with the British military, including special forces, as well as with the intelligence services. In 1992 Peter de la Billiere, former commander in chief of the SAS and then UK Special Forces, and commander of the British land forces in the Gulf war, was appointed a non-executive director of Robert Fleming & Co., a post he retained for seven years.[11][12] Rupert Wise, described in the Daily Telegraph as 'The banker with a CV out of a spy novel'[13] became managing director of its Middle East division in around 1984; and Mark Bullough, who went on to co-found the mercenary company Aegis Defence Services with Lt Col Tim Spicer, worked at Robert Fleming & Co. for 20 years.[14] Dominic Armstrong was Bullough’s deputy at Jardine Fleming, the subsidiary of Robert Fleming and Co. in Malaysia.[15] Bullough and Tim Spicer had been comrades in the Scots Guards and had fought together in the Falklands. Both Spicer and Simon Mann, the mercenary jailed for his part in the failed coup in Equatorial Guinea, and de la Billiere had also worked closely together. So Flemings looks like a bolthole or temporary perch for intelligence connected/special forces people.

One person who apparently does not fit this description is the BBC journalist Frank Gardner, who took over the Bahrain office of the bank after Rupert Wise and worked in the post 1986-95.[16] Gardner has publicly stated that he rejected an invitation to join MI6 before he graduated from Exeter University.[17]

The right wing historian Andrew Roberts also reportedly turned down an MI6 recruitment attempt. While at Cambridge, Roberts was approached to join the 'FCO Co-ordinating Staff', a euphemism for [MI6]. He went through the selection process, but decided not to join. [18] He later joined Flemings too.[19]

A famous scion of the Fleming family with intelligence links was Ian Fleming, the author of the James Bond novels, who was the grandson of Robert Fleming, the founder of Robert Fleming & Co. Before his novel-writing career, Ian Fleming worked as a journalist and spy for the Foreign Office.[21]

Decline

In 1997, Robert Fleming Holdings had operations in 44 countries in Asia, Eastern Europe, the Americas and Africa. Its net assets as for the 1997 fiscal year were £841 million and its profit before tax for the year was £136.1 million. Its global asset management business managed £63 billion on behalf of institutional and private investors around the world. These results included Jardine Fleming, which in its own right had operations in 15 countries in the Asia-Pacific region, seats on 20 stock exchanges and some US$19.7 billion in funds under management. Jardine Fleming’s profit before tax for the year was US$41.4 million.[22] The firm’s significant transactions included the privatization of state-owned Pakistan Telecommunication Co. Ltd. in 1994.

Through its history, the firm wore its Scottishness on its sleeve. In addition to being controlled by the Scottish Fleming family, there were other signs of its Scots heritage. A bagpipe player regularly greeted visitors at its London headquarters until 2000. In the 1990s, its main non-Fleming family backers were Scottish institutions such as Baillie Gifford and Stewart Ivory. The firm also owned the most extensive private collection of Scottish art in existence, removed to an art Foundation, The Fleming-Wyfold Art Foundation, created to protect the art works and prevent any buyers of the failing bank from selling off the collection.

Scandal, crisis and restructuring

The Fleming name was tarnished by a scandal in 1996, when Jardine Fleming was ordered to pay $19 million to fund investors for alleged abusive and unsupervised securities allocation practices by asset management head Colin Armstrong. The 1997 Asian crisis severely hit both Robert Fleming and Jardine Fleming. Robert Fleming was forced to approve massive lay offs in late 1998. The firm restructured in 1999, buying the remaining 50% stake in Jardine Fleming in return for giving Jardine Matheson an 18% stake in Robert Flemings Holdings.[23] However, despite these efforts, Flemings continued to see its investment banking and asset management market share decline as global investment banks like Morgan Stanley and Lazard moved into their markets.[24]

Sale to Chase

In April 2000, Robert Fleming Holdings was sold to Chase Manhattan Bank for $7.7 billion (then £4.5 million).[25] Although the sale came about as partially as a result of Fleming's weakened position, it was part of two larger trends: consolidation in the financial services industry as large U.S. commercial banks acquired investment banks upon the repeal of the Glass-Steagall Act, and the sale of UK merchant banks to foreign banks. Flemings, with almost no US assets, was considered a particularly good fit for increasingly globally-minded Chase, whose assets lay largely in the United States. In the sale about 130 Fleming family members pocketed approximately $2.3 billion for their 30% stake. When Chase merged with JP Morgan in 2002, the Fleming asset management business was rebranded J.P. Morgan Fleming.

After 2000

The members of the Fleming family have since set up an asset management company, Fleming Family & Partners, chaired by former Morgan Grenfell head John Craven. In 2005, they sold 20% of the business to Standard Chartered Bank, a venerable Hong Kong institution like Jardine Matheson, for £45 million. The bank business of Jardine Fleming was bought by Standard Bank, a large South African bank, in 2001.

People

- Peter de la Billiere | Mark Bullough | Frank Gardner | Andrew Roberts | Timothy Steel'joined Cazenove in 1980 from Robert Fleming'[26] | Alan Sutherland |

Affiliations

Subsidiaries

Publications

Contact details, Resources, Notes

Contact

- Address:

- Phone:

- Fax:

- Website:

External Resources

Notes

- ↑ Robert Fleming Holdings Limited, Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010

- ↑ Robert Fleming Holdings Limited, Company Overview, Business Week, March 29, 2010, acc 29 Mar 2010

- ↑ Robert Fleming Holdings Limited, Bloomberg Business Week, undated, acc 30 Mar 2010

- ↑ Chase in £7.7bn Fleming bid, The Independent, 11 April 2000, acc 29 Mar 2010

- ↑ Marc Sousley, Chase lands Fleming for $7.7bn, Financial News, 11 Apr 2000, acc 30 Mar 2010

- ↑ Robert Fleming Holdings Limited, Bloomberg Business Week, undated, acc 30 Mar 2010

- ↑ Marc Sousley, Chase lands Fleming for $7.7bn, Financial News, 11 Apr 2000, acc 30 Mar 2010

- ↑ Jane Lewis, Profile: The Flemings, MoneyWeek, 21 Dec 2005, acc 30 Mar 2010

- ↑ Jane Lewis, Profile: The Flemings, MoneyWeek, 21 Dec 2005, acc 30 Mar 2010

- ↑ Jane Lewis, Profile: The Flemings Moneyweek, Dec 21, 2005, acc 30 Mar 2010

- ↑ Topaz Amoore, Column Eight: Bridging the gulf at Fleming, The Independent, 15 Jul 1992, acc 30 March 2010

- ↑ Higher colleges of Technology Sir Peter de la Billiere, Dubai, acc 30 Mar 2010

- ↑ Ben Fenton 'The banker with a CV out of a spy novel' Daily Telegraph 12/11/2005, accessed 28 March 2010

- ↑ Management Information - AEGIS private security company, accessed 13 April 2008.

- ↑ Malaysia Business Law Handbook, Washington DC: USA International Business Publications, Screengrab, accessed 30 March 2010

- ↑ Profile: Frank Gardner, BBC News, 7 Jun 04, acc 30 Mar 2010

- ↑ David Rowan, Shot six times, but I won't be silenced; BBC correspondent Frank Gardner, just awarded an OBE, warns that the media must keep the terror threat in perspective, The Evening Standard, Jun 15 2005, acc 30 Mar 2010

- ↑ MI6: Inside the Covert World of Her Majesty's Secret Intelligence Service, by Stephen Dorril, Touchstone, 2002, p.783.

- ↑ Christopher Monckton, The Aids Report: An examination of public health policy on AIDS, London: Policy Search, 14 Tufton Street, Westminster, SW1, May 1987.

- ↑ Malaysia Business Law Handbook, Washington DC: USA International Business Publications, p. 280

- ↑ John Cork, The Life of Ian Fleming (1908-1964), 1995, acc 30 Mar 2010

- ↑ http://www.irasia.com/listco/sg/jm/press/p981203.htm%7C Fleming Holdings press release, Dec. 3, 1998.

- ↑ Garfield, Andrew, Fleming cements ties with Keswicks, The Independent, 4 December 1998, acc 30 Mar 2010

- ↑ Garfield, Andrew, Fleming cements ties with Keswicks, The Independent, 4 December 1998, acc 30 Mar 2010

- ↑ Chase in £7.7bn Fleming bid, The Independent, 11 April 2000, acc 29 Mar 2010

- ↑ PDF Copy of <www.committedcapital.co.uk/team/advisory-board/tim-steel> created 27 April 2010.