Difference between revisions of "GSV Capital"

Tamasin Cave (talk | contribs) (→The resulting profitable market) |

Tamasin Cave (talk | contribs) (→The resulting profitable market) |

||

| Line 78: | Line 78: | ||

====The resulting profitable market==== | ====The resulting profitable market==== | ||

Investment opportunities as a result of:<br> | Investment opportunities as a result of:<br> | ||

| − | '''the focus on results/outcomes, more | + | '''the focus on results/outcomes, more testing, and holding schools and teachers to account from that data''' |

*tools to be used in school that promise to raise test scores | *tools to be used in school that promise to raise test scores | ||

*consumer funded education products and services (i.e. privately purchased by parents to be used outside school) | *consumer funded education products and services (i.e. privately purchased by parents to be used outside school) | ||

Revision as of 10:39, 4 December 2015

|

This article is part of the Spinwatch privatisation of Schools Portal project. |

GSV is a US venture capital fund that invests heavily in education start-ups, among other things.

Contents

Core business

Launched in April 2011, GSV (which stands for 'Global Silicon Valley'), defines six themes that it feels have the greatest investment potential: Social Media, Mobile Computing and Apps, Cloud Computing, Software as a Service, Green Technology, and Education Technology.

Portfolio

As of August 2015:

- Knewton, adaptive learning company

- 2U, online education platform

- Avenues, private school chain

- Chegg, online textbook rentals, homework help, online tutoring etc

- Curious.com, online 'lifelong learning' firm

- Coursera, a for-profit edtech company offering online courses (MOOCs)

- Declara, a 'personalised learning' software company,

- General Assembly, a New York City 'startup campus' featuring courses relevant to internet startups

- Tynker, programming courses for kids

Lobbying

2012: the battle plan

In 2012, GSV founder, Michael Moe published a blueprint for radical reform of America's education system:

'It should not be lost on us that revolutions are actually a fairly common occurrence in modern society. The most recent prominent example is the “Arab Spring,” but since 1900, there have been over 250 governments overturned by revolutionary action... The revolution America needs today is not against an oppressive monarchy, but rather against an educational system that has equally oppressive effects. Fortunately, we have the arms and technology to fight this war.[1]

The Nation's Lee Fang comments:

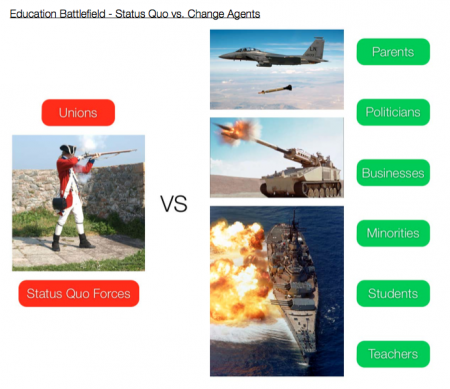

- 'The revolution GSV goes on to describe is a battle to control the fate of America’s K-12 education system. Noting that this money is still controlled by public entities, or what’s referred in the document as “the old model,” the GSV paper calls for reformers to join the “education battlefield.” (A colorful diagram depicts “unions” and “status quo” forces equipped with muskets across businesses and other “change agents” equipped with a fighter jet and a howitzer.) The GSV manifesto declares, “we believe the opportunity to build numerous multi-billion dollar education enterprises is finally real.”'[2]

'Time to Fight'

The manifesto includes a chapter titled 'Time to Fight' (which is followed by a quote from the film The Untouchables: 'He pulls a knife, you pull a gun. He sends one of yours to the hospital, you send one of his to the morgue.') It includes case studies profiling education technology business - the 'Special Forces' of Moe's revolution – a large number of which are in GSV's investment portfolio.

'Battle Strategies

It concludes with a series of 'battle strategies', which it believes will bring about radical, market-driven, education reform ('We believe that capitalism works,' it reads, adding that 'market forces will do a lot of the heavy lifting').

The 'battle strategies' include:

- eliminate the term “education reform” as we focus on education innovation as the means to solve our education problem.

- outlaw the terms “for-profit” and “not-for-profit” as they represent corporate structures and thus have no bearing on the effectiveness of a particular program or product. Return on Education (”ROE”) becomes the objective measurement to determine if an education program is good or bad.

- embrace the philosophy of choice and competition by creating an even playing field for charter schools, virtual charters and other alternative programs

- buy every pre-K through 6th grade student in America a tablet computer

- establish Computer Language as a core curriculum that will be required from kindergarten on up

- create an open marketplace for information on all schools, administrators, teachers, and ROE for educational products and services

- adopt the Common Core (standardised tests) in all 50 states and create incentives for innovators to develop disruptive, high-impact content.

- make Teach for America even more celebrated and scaled by enrolling the nation’s brightest college graduates to teach for two years

- implement a “universal” pre-school voucher program

- establish... national standards [that] are consistently applied, with real consequences for schools that don’t teach, and conversely, real rewards for schools that are effective.

- create tax-deductible individual learner savings accounts

- institute a “Truth in Education” policy. Students and parents sign a document before they accept enrollment that they have read and understand the percentage of students that graduates, the number of years it takes to graduate, the percentage of graduates that find a job within 12 month, the average starting salary, and the average student loan amount.

2005: the investment opportunity

In 2005, Michael Moe's previous company, investment bank ThinkEquity Partners, published a report on the investment opportunities it saw in the US education system. New Rules, New Schools, New Market: K12 Education Industry Outlook 2005 is a useful introduction to how the investment world views education, which is as a profitable market, albeit one that they hope will benefit from their investments; and the factors driving these opportunities. The report, which is a decade old (in 2015) begins:

'We believe the U.S. K12 school system is undergoing structural changes that have the potential to redefine and expand the role of business in the $500+ billion market over the next decade.

It puts the 'domestic business opportunity' in the primary and secondary school market, known as K12 in the US, at $163 billion by 2015 'as the K12 market moves into an age of data, efficiency, technology and globalization'.

Barriers to change

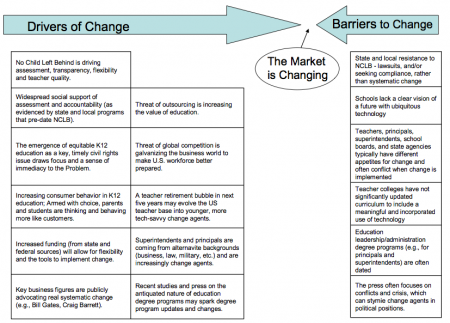

Businesses wanting to get involved in state education, including those that see technology and the digitisation of teaching and learning as the answer, face numerous hurdles, the report notes:

- Americans in the main oppose business trying to profit from public education systems: 'there remains a pervasive stigma', about it.

- The school system is large, fragmented, bureaucratic and unionised.

How to crack the market then?

Drivers of reform

First define 'The Problem' (to which more involvement from business is the answer). The report identifies the problem with the US public schools system as: 'stagnant student outcomes', the achievement gap between racial and socioeconomic groups, globalisation and the threat of outsourcing. It notes that these factors 'all meant the stage was set for a major, top-down, sweeping reform package' at the turn of the century. President Bush responded with new policies, named 'No Child Left Behind', which tied funding to market reforms: school choice, an increase in assessment and a reliance on data to improve accountability. The report notes that Bush's reforms initially had little impact.

However, positive signs that the system is changing, and becoming more attractive to investors, include:

- workforce changes: different people are in charge now, what the report calls the 'evolving school leadership base', who are more business and technology friendly. Of the 'drivers of change' in education, it believes the most significant are to do with the workforce (often identified as the barrier to reform). It boils down to this: getting rid of experienced unionised teachers with younger, less experienced, more tech savvy people. 'With a teacher retirement bubble coming, we believe the new teacher base will be younger and will include more career switchers, both of which are generally more tech-savvy and forward thinking.' School bureaucrats and local education leaders also need to make way for those from non-education backgrounds 'who may be more willing to take advantage of the tools and services the business world offers'.

- pressure from the government: the focus on holding schools and teachers to account, introduced by the 'No Child Left Behind' reforms, make schools more 'results oriented'. What this means is that schools become focused on an increasingly narrow set of 'outcomes', like test scores

- make it all about 'outcomes': focus has shifted from discussions around best teaching (the means / pedagogy) to 'student outcome data' (the ends). In other words, if a product or service improves test scores, who cares how they did it, it has a place in the market 'despite feuding theorists and/or anti-for-profit sentiment'. Businesses just need to show that their solutions raise test scores, which is all (they have said) matters.

- business thinking: as schools become more focused on data and outcomes, it brings them closer to business-thinking. Schools are warmer to the offering from business (efficiencies etc)

- redefine education success: politicians and parents are led to reevaluating what matters in education (namely 'outcomes') through transparency measures like school league tables

- create additional consumer demand: a 'byproduct' of this focus on results is that schools have learnt to game the system by focusing more attention on the students that are in the middle, and trying to drag those that are just below the pass mark up. This brings investment opportunities in straight to consumer education products – add-ons – for those students that aren't in this bracket and want more.

The resulting profitable market

Investment opportunities as a result of:

the focus on results/outcomes, more testing, and holding schools and teachers to account from that data

- tools to be used in school that promise to raise test scores

- consumer funded education products and services (i.e. privately purchased by parents to be used outside school)

- increased use of consumer or public pay supplemental education (e.g., tutoring, after school programs, etc)

focus on school choice and 'alternative routes to education'

- charter schools

- virtual schools

- special needs programs

fewer barriers to technology in classrooms

- digital instructional content

- digital ongoing assessment

- data management and analysis software

'As a result of these trends, we believe the system will finally enter the 21st century in the coming decade. When it does, we believe the $500-plus billion US K12 education system will be more closely integrated with the business world, allowing for numerous, long-legged investment opportunities.'

Political links

- Bob Grady, member of GSV advisory board. A close confidant of New Jersey Gov. Chris Christie and former chairman of the $81 billion New Jersey Investment Council. Also former Deputy Assistant to President George H. W. Bush

Investors/People

- Michael Moe, founder and CEO of GSV Asset Management; ex-director at Merrill Lynch. Described as being 'on the cutting edge of investment for more than 20 years'.[3] Moe predicted in his book Finding the Next Starbucks: How to Identify and Invest in the Hot Stocks of Tomorrow: 'We see the education industry today as the healthcare industry of 30 years ago.'

Contact

- website: http://gsvcap.com

References

- ↑ July 2012, American Revolution 2.0: How Education Innovation is Going to Revitalize America and Transform the U.S. Economy, accessed August 2015]

- ↑ Lee Fang, Venture Capitalists Are Poised to ‘Disrupt’ Everything About the Education Market, "The Nation", 25 September 2014

- ↑ Want to invest early in the next big startup? Ask Michael Moe, ZDNet, 16 May 2014