Difference between revisions of "IGas Energy"

(→Licences) |

(→Financial affiliations) |

||

| Line 213: | Line 213: | ||

==Financial affiliations== | ==Financial affiliations== | ||

| − | Investors include [[Kerogen Capital]] an independent private equity fund manager specialising in the international oil and gas sector with over $2 billion under management. It has held a 28% shareholding in the UK oil and gas exploration company [[Igas Energy]] since a refinancing deal in 2017 that saw Kerogen inject US$35million of fresh funds into the firm via its [[Unconventional Energy Limited]] vehicle alongside IGas' debt-for-equity deal with its lenders to help ease its financial pressure and debt burden.<Ref> Proactive Investor, [https://www.proactiveinvestors.co.uk/companies/news/176089/kerogen-capital-ends-up-with-near-28-shareholding-in-igas-energy-following-completion-of-its-recent-refinancing-176089.html Kerogen Capital ends up with near 28% shareholding in iGas Energy following completion of its recent refinancing], 06 Apr 2017, accessed 28 June 2019 </ref>Igas non-executive board member [[Philip Jackson]] serves on Kerogen’s Investment Committee. <ref> IGas Energy plc [https://www.igasplc.com/about-us/board-of-directors/philip-jackson IGas Energy board of directors], IGas website, page last accessed 28 June 2019 </ref> | + | Investors include: |

| + | * [[Kerogen Capital]] an independent private equity fund manager specialising in the international oil and gas sector with over $2 billion under management. It has held a 28% shareholding in the UK oil and gas exploration company [[Igas Energy]] since a refinancing deal in 2017 that saw Kerogen inject US$35million of fresh funds into the firm via its [[Unconventional Energy Limited]] vehicle alongside IGas' debt-for-equity deal with its lenders to help ease its financial pressure and debt burden.<Ref> Proactive Investor, [https://www.proactiveinvestors.co.uk/companies/news/176089/kerogen-capital-ends-up-with-near-28-shareholding-in-igas-energy-following-completion-of-its-recent-refinancing-176089.html Kerogen Capital ends up with near 28% shareholding in iGas Energy following completion of its recent refinancing], 06 Apr 2017, accessed 28 June 2019 </ref>Igas non-executive board member [[Philip Jackson]] serves on Kerogen’s Investment Committee. <ref> IGas Energy plc [https://www.igasplc.com/about-us/board-of-directors/philip-jackson IGas Energy board of directors], IGas website, page last accessed 28 June 2019 </ref> | ||

| + | *KKR owns 14.7% of IGas through [[KOG Investments]] S.A.R.L. KKR executive [[Hans Arsted]] - sits on Igas Energy's non-executive board as part of KKR's rights to take up a seat. | ||

===Financiers over time=== | ===Financiers over time=== | ||

| − | |||

*[[Barclays]], banker | *[[Barclays]], banker | ||

*[[Ernst & Young]], auditor | *[[Ernst & Young]], auditor | ||

Revision as of 04:48, 28 June 2019

|

This article is part of the Spinwatch Fracking Portal and project |

IGas Energy Ltd is Britain's largest independent oil and gas explorer and developer, with licences to explore for oil and gas across the country including the North West, East Midlands, the Weald Basin in southern England and the northern coastal area of the Inner Moray Firth in Scotland. [1]

IGas is owned by its founding executives, several investment funds including Kerogen Capital and KKR, alongside the Beijing-based China National Offshore Oil Corporation Ltd (CNOOC), which holds nearly 20 per cent. It has a market capitalisation of £69.16 million.

In February 2019 IGas announced that its longstanding chief operating officer, John Blaymires would retire.

Contents

- 1 Shale gas a 'game-changer' for Britain

- 2 Activities

- 3 Political access

- 4 Injunctions against protestors at UK fracking sites

- 5 Policing costs for two IGas sites released

- 6 Cheshire public inquiry 2019

- 7 Oil and gas production output

- 8 Licences

- 9 People

- 10 Affiliations

- 11 Lobbying and PR firms

- 12 Subsidiaries and acquisitions

- 13 Financial affiliations

- 14 Contact

- 15 Resources

- 16 Notes

Shale gas a 'game-changer' for Britain

In 2014 IGas was pushing the line that shale gas would be a 'game-changer' for Britain, and that it could be 'extracted cleanly and safely'.

Igas chief executive at the time Andrew Austin described his hopes for UK fracking as 'a very big prize' - whereby in the 'best-case scenario' up to 10 per cent of the UK's gas supply for the next decade could come from shale gas produced in Lincolnshire and Nottinghamshire.

IGas was already producing conventional oil and gas in the area, and said it hoped to develop up to 15 fracking sites in 10 years.[2]

Activities

Dart Energy buyout

In May 2014 IGas bought rival producer Dart Energy, which holds licences to produce gas from coal seams in Scotland. The deal, worth £120 million, made IGas the UK's biggest shale gas explorer at the time, with more than a million acres under licence.[3]

Barton Moss site criticised by MP

In February 2014 Barbara Keeley, UK Labour MP for Worsley and Eccles South criticised IGas's potential fracking site at Barton Moss in Salford, Greater Manchester as 'manifestly unsuitable', with drilling there causing 'absolutely huge inconvenience' to residents and businesses. She also described the process of 'fracking' - exploring below the surface for possible shale gas reserves - as "controversial and untested".

- Keeley, in an interview with Govtoday, insisted the scheme should "never have been brought into that part" of the region, adding: "If you think that there are meant to trillions of cubic metres of shale gas said to be in the north-west, why start in an urban area with very poor access?" [4]

Deal with Ineos

In March 2015 IGas agreed a deal with chemicals giant Ineos to sell it a 50 per cent interest in seven of IGas’ shale gas licences in the North West along with the option to acquire a 20 per cent interest in two further IGas licences in the East Midlands. The deal was worth £30 million in cash and a further £138 million commitment to fund a two-phase work programme to develop the sites. [5]

Drills first shale gas wells in Nottinghamsire

IGas began drilling the first shale gas well in Nottinghamshire in November 2018. The Tinker Lane shale gas exploration site near Blyth was initially delayed by an 80-hour 'lock-on' protest blocking the site entrance.[6]

By December 2018, however, IGas had announced that its drilling tests at Tinker Lane failed to find the target Bowland Shale. It said it would therefore abandon and restore the well site.

Test drilling at IGas' Springs Road site has been more successful according to an early February 2019 press release:

- Drilling operations at Springs Road-1 are progressing well. We have encountered shales on prognosis, at c.2,200 m, including the Bowland Shale horizon and coring will commence imminently. The rate of drilling at Springs Road has been quicker than anticipated, building on our learnings and operating efficiencies from Tinker Lane and augurs well for the future. [7]

Progress on the drilling was included in the IGas chairman's statement in its FY2018 results released in March 2019:

- We mobilised the equipment to Springs Road in early January 2019 and spudded the well on 22 January 2019. In mid-February, we encountered shales on prognosis, at c.2,200 metres depth and drilled through a hydrocarbon bearing shale sequence of over 250 metres, including the upper and lower Bowland Shale. TD has been reached at 3,500 metres after encountering all three targets – Bowland Shale, Millstone Grit and Arundian shales. Significant gas indications were observed throughout the shale section and additionally within the Millstone Grit sequence and the Arundian shale. The cores and wireline logs will now undergo a suite of analysis, the first results of which should be available in the second quarter of 2019." [8]

On 27 June 2019 Igas CEO Stephen Bowler told investors in a statement that results from the Springs Road SR-01 well, which was drilled as a vertical, cored well in PEDL140 in the centre of the Gainsborough Trough basin, were 'highly promising' and a “step forward for shale gas development in the East Midlands”. He said the core analysis confirmed 'a significant hydrocarbon resource'. [9]

Political access

Igas has long enjoyed direct access to the UK government's senior ministers and officials. Press and photo opportunities as part of the shale gas industry's push to get fracking going in the UK included former prime minister David Cameron visiting an Igas site in 2014 (above right), and former Defra minister Andrea Leadsom.

Attendee at UK energy minister's May 2018 shale gas roundtable

Energy minister Claire Perry hosted a roundtable with the fracking industry just hours before she gave evidence to a committee of MPs on the Conservative government's proposed changes to relax the rules on shale gas development in the UK.

A 'reconstructed' attendee list was released under the freedom of information act to North Yorkshire resident Jonathan Bales following an internal review of the Department for Business, Energy and Industrial Strategy's initial almost completely redacted FOI response. [10] By 2018 this had dropped to an average net production of 2,365 barrels of oil equivalent per day.

Oil and gas companies at the roundtable included:

- Aurora Energy, BP, Cuadrilla, IGas, Ineos, Third Energy and lobby group UK Onshore Oil and Gas.

- Service companies: Ground Gas Solutions, Marriott Drilling, Onshore Energy Service Group, Zetland Group.

- Investors and fund managers: Riverstone (a major partner in Cuadrilla), Kerogen (investor in IGas), Global Natural Resource Investments (formerly part of Barclays which invested in Third Energy), KKR, JP Morgan.

Other industries and organisations: Chemical Industries Association chemical company SABIC, Coalfield Regeneration Trust, Engineering Employers’ Federation, GMB. [11]

Injunctions against protestors at UK fracking sites

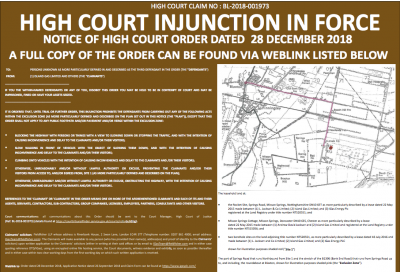

Igas Energy's shale gas plans have been met with extensive protest in the both areas it proposes to work in and operates. Following INEOS' successful applications for anti-protest SLAPP style injunctions against public protest, on 3 September 2018 IGas obtained a High Court injunction against 'unlawful protest' at three of its main shale gas exploration sites[12] (Springs Road and Tinker Lane in Nottinghamshire and Ellesmere Port in Cheshire).

The interim injunction was renewed in the High Court in London on 28 December 2018 (right) by HHJ Simon Barker QC.

IGas claims the order ‘doesn’t prevent anyone effectively exercising their rights to freedom of assembly and freedom of expression’. Restrictions prohibited "trespass on IGas’ land, unlawful interference with access to IGas’ land, and obstruction of the highway – including slow-walking, lock-walking, lock-ons and truck surfing". Any activists disobeying the injunction may be held to be in contempt of court and subject to prison, fines or seizure of asset. .[13]

Policing costs for two IGas sites released

In June 2019, community campaigners learned that policing at two IGas shale gas sites, Tinker Lane and Springs Road near Misson, in Nottinghamshire had cost £900,000 up to April 2019 - nearly 0.5% of the Nottinghamshire force’s entire spending on policing services for 2017-2018. However, the Police and Crime commissioner's office told Drill or Drop that it would not be seeking reimbursement for the costs, which were below the Home Office threshold. [14]

Frack Free Misson said in a statement:

- “Apart from the financial impact, the imposition of the fracking industry upon our community has led to the diversion of police resources away from their duties of serving and protecting the communities who pay for them. Council tax payers and local businesses have had to contend with increasing levels of crime and anti-social behaviour, whilst dozens of police are deployed at the behest of a private corporation to facilitate the unjustifiable extraction of fossil fuels.”

Cheshire public inquiry 2019

Igas' plan to ‘flow test’ its existing well in Ellesmere Port was overwhelmingly rejected in January 2018 by Cheshire West and Chester Council's planning committee members by 10 votes against the single vote of chairman Cllr Alex Black (Lab, Hoole). [15]

Igas is appealing against the council's refusal and claims it does not intend to use hydraulic-fracturing at Ellesmere Port.

Public health and social impacts

An 8-day public inquiry held in Chester in January 2019 heard evidence from expert witnesses on the potential health and social impacts of IGas' proposed operations at the site. DrillorDrop reported that Professor Andrew Watterson of Stirling University, giving evidence on behalf of Frack Free Ellesmere Port and Upton (FFEP&U), argued Igas was using the 'absence of evidence' as evidence of absence.' "Nothing in the IGas appeal documents deals effectively with public health objections to the proposal,” he said. The campaigners also believe that while IGas' claims that it will not frack at Ellesmere Port, 'the proposed use of acid to stimulate gas flow meets the council’s local definition of fracturing'.

- “From a public health and air quality impact perspective, the IGas proposal does not appear to demonstrate sustainable development but rather the opposite. Not all the project hazards were initially identified or have been fully now. The effects of these hazards combined, and with other hazards in the area, has not been fully factored into risk assessments of human health.”

Professor Watterson explained that IGas had also not fully considered the vulnerability of the local population of Rossmore and Ellesmere Port Town, one of the country's most deprived areas. According to campaigners, the site, called Portside, is at the heart of their community - within 1km of new homes, a children’s play centre and a nature reserve. Just over 1km away is a residential home, schools and tourism attractions reported DrillorDrop. [16]

Poor public engagement

Another expert witness, academic Dr Anna Szolucha, said IGas 'had a poor record of public engagement', with many residents regarding local consultations as inadequate, also perceiving the IGas scheme as 'unfair' and that 'any potential economic benefits would not compensate for potential adverse impacts'. These communities, she argued, were experiencing 'a collective trauma' and 'felt powerless, depressed, with a sense of loss, fear, betrayal, guilt and anger'. [17]

Appeal decision delayed by consideration of UK government's climate change targets

The 12-day Cheshire public inquiry ended in early March 2019. In June however, it emerged that the Planning Inspectorate had delayed its decision following the government's climate change advisor recommendation for a greenhouse gas reduction target of net zero by 2050. It told Drill or Drop:

- “The decision [on the Ellesmere Port inquiry] had to be postponed to seek comments/representations following the Government’s Climate Change Committee’s net-zero report published in May. These comments will now be considered by the Inspector and a revised date for issuing the decision will be made as soon as possible”. [18]

Oil and gas production output

IGas produced approximately 3,000 barrels of oil and gas a day from over 110 sites across the country in 2013. Primary production areas covered the East Midlands (Welton and Gainsborough), Cheshire, Flintshire and Staffordshire, as well as in the Weald Basin in southern England. At the time, IGas estimated that within its own licence area, covering 300 square miles between Manchester and Liverpool, there is likely to be in the region of 102 Tcf of gas in place (midcase). Britain’s total gas use currently runs at 3 Tcf a year.[1]

In the year to 31 March 2013, IGas produced over 901,000 barrels and achieved £68.3 million in revenue. [19]

Licences

- IGas has a petroleum exploration and development licence (PEDL) for the Gainsborough area[2]

- East Midlands – PEDL 139/140: In 2014 IGas signed a farm-out agreement with Total E&P UK Limited (“Total”), under which Total acquired a 40 per cent interest in the 139/140 Licences. Total will fund a fully carried work programme of up to US$46.5m, with a minimum commitment of US$19.5m. IGas was appointed operator on the Licences with an increase in equity interest to 14.5 per cent.[1]

- North West: IGas has seven onshore licences, located in the counties of Cheshire, Flintshire and Staffordshire, that contain the Carboniferous Coal Measures and Bowland-Hodder shales. The total area under licence in this region is 1,020km2 (approximately 252 k.acres), where it owns 100% working interest in all licences.[1] Drilling of an exploration well at Barton Moss near Manchester began in November 2013 and was completed in March 2014 and on budget. IGas stated:

- The well is now suspended and 'full laboratory analyses of the cores is underway the results of which are expected in the late Autumn (2014). The results from the core analyses together with thewireline log data will be integrated and utilised to determine the next steps in the appraisal process. The core data will be very beneficial in understanding the geomechanical aspects of the shales and this will help provide key data to optimise the design of any future programme involving hydraulic fracturing of the Bowland Shale.

- In 2018 drilling at Tinker Lane site in Nottinghamshire failed to find the target Bowland Shale basin; Igas announced in early 2019 it would abandon and restore the site.

Constituencies including IGas licences

- Arundel and South Downs – Nick Herbert

- Barnsley Central – Dan Jarvis

- Barnsley East – Michael Dugher

- Bassetlaw – John Mann

- Bognor Regis and Littlehampton – Nick Gibb

- Chichester – Andrew Tyrie

- Congleton – Fiona Bruce

- Crewe and Nantwich – Edward Timpson

- Don Valley – Caroline Flint

- Doncaster Central – Rosie Winterton

- Doncaster North – Ed Miliband

- East Surrey – Sam Gyimah

- Eddisbury – Antoinette Sandbach

- Gainsborough – Edward Leigh

- Hemsworth – Jon Trickett

- Louth and Horncastle – Victoria Atkins

- Newark – Robert Jenrick

- Newcastle-under-Lyme – Paul Farrelly

- Normanton, Pontefract and Castleford – Yvette Cooper

- North Shropshire – Owen Paterson

- Rother Valley – Kevin Barron

- Rotherham – Sarah Champion

- Scunthorpe – Nic Dakin

- Sheffield Central – Paul Blomfield

- Tatton – George Osborne

- Wakefield – Mary Creagh

- Wentworth and Dearne – John Healey

Coal Bed Methane (CBM) pilot

IGas started commercial sales of electricity generated from CBM in 2009. According to the IGas website:

- The Doe Green pilot Coal Bed Methane (“CBM”) site continues to produce gas and generate electricity. All three production wells, each of which is testing a separate seam, demonstrate that gas is flowing from the seams. [20]

As of 2017 this site was operated by Ineos.

Community liaison groups

- Tinker Lane Community Liaison Group - IGas made the minutes from this group available throughout 2016, last available dated 12 February 2018. The group itself publishes a variety of information on its website, and a summary of its latest available minutes is dated 9 February 2019. [21]

People

- Stephen Bowler CEO since 2015 and previously chief financial officer. Steve started his career at Touche Ross, now Deloitte, where he qualified as a chartered accountant. [22]

- Ann-marie Wilkinson - Director of Corporate Affairs (previously head of communications [23]

- Julian Tedder, Chief Financial Officer since 2015. Previous work experience includes Tullow Oil and Centrica plc

- Barrie Hedges Igas Community Fund circa 2014

Former executives

- Andrew Austin -Ex-CEO and founder of IGas. Was an executive director from 2004-15 and CEO from 2007-15 with full-time responsibility for the day to day operations and business development. [22] Holds a 5.41% shareholding in IGas.[24]Now at Rockrose Energy.

- John Blaymires chief operating officer for eight years to February 2019. Blaymires' international experience in the oil and gas industry before joining IGas had including working at Hess Corporation and Shell International. [22]

Board

- Cuth McDowell - non-executive director and chair of the Audit Committee appointed December 2012. Has 33 years of international experience in the oil and gas sector, having held a range of leadership positions in Exploration and Production. [22]

- Mike McTighe non-executive director and Chairman

- Hans Arsted - appointed May 2019, a principal in Igas Energy investor KKR's European Private Equity team [25]

Former non-executive members

- Francis Gugen - Non-executive chairman. Francis is a founder and non-executive chairman with over 30 years of oil and gas industry experience. [22] Held a 13.4% shareholding in IGas

- Robin Pinchbeck - appointed non-executive director July 2012. Pinchbeck began his career at BP where he held various management roles over two decades. He was CEO of operations services and then group director of strategy at Petrofac. [26]

- John Bryant - Senior Independent Non-Executive Director. John is the Chairman of AIM-listed Weatherley International plc, and a board member of AIM-listed China Africa Resources Plc. [22]

Company directors

- John Blaymires, director, 19 Oct 2010-February 2019

- Andrew Austin, director, 27 Dec 2007-15

Current

- John Bryant, director, 5 May 2004-

- FRANCIS ROBERT GUGEN, director, 27 Dec 2007-

- STEPHEN DAVID BOWLER, director, 1 Nov 2011-

- ROBIN HUNTER PINCHBECK, director, 11 Jul 2012-

- inactive JOHN GREER BUTLER, secretary, 14 Jan

Affiliations

- Associate Parliamentary Group for Energy Studies

- All-Party Parliamentary Group on Unconventional Oil and Gas, associate member.[27] Gave a contribution of £3000 from Igas Energy PLC (registered May 2014). [28]

- According to the Salford Star in February 2014, 'Peel Holdings, or the Peel Group, not only own Barton Moss Road but all the fields surrounding it, including the iGas drilling site, and Barton Airport where the police are based during operations, drawing rent off all of them. It now appears that the company... is preparing to evict anti-fracking campaigners.

- Member of D Group

Lobbying and PR firms

- Lexington Communications provided UK public affairs consultancy services to 'Island Gas' from 2011- August 2014. [29]

- MHP Communications provided UK public affairs consultancy services to IGas Energy from 2014 [30] - Rupert Trefgarne, Andrew Leach and Barnaby Fry - 2015

- Bellenden Public Affairs

- Kreab Gavin Anderson provided UK public affairs consultancy services to IGas Energy from June 2011 [31]until May 2013.

- Vigo Communications - named regularly on investor statements, Patrick D'Ancona/ Chris McMahon

Subsidiaries and acquisitions

- On 28 February 2013, the Company completed the acquisition of PR Singleton from Providence Resources plc [1]

- December 2013: Acquisition of Caithness from Caithness Petroleum plc for £7.9m (including assumed borrowings and closing adjustments) which was financed by issuing 7,488,301 Ordinary Shares. [1]

- Acquisition in 2011 of Star Energy and equity fundraising of £20.6m.

- Signed an agreement with Nexen Petroleum UK Limited to acquire Nexen Exploration UK Limited, making our Group the operator and sole owner of all our licences.

- Island Gas Limited Exploration for and evaluation, production and marketing of oil and gas

- Island Gas (Singleton) Limited Production and marketing of oil and gas

- Island Gas Operations Limited Electricity Generation

- IGas Energy (Caithness) Limited Production and marketing of oil and gas

- IGas Exploration UK Limited Production and marketing of gas

- Star Energy Group Limited Service Company

- Star Energy Limited Service Company

- Star Energy Weald Basin Limited Processing of oil and gas

- Star Energy Oil and Gas Limited Service Company

- Star Energy (East Midlands) Limited Dormant

- Star Energy Oil UK Limited Dormant

Financial affiliations

Investors include:

- Kerogen Capital an independent private equity fund manager specialising in the international oil and gas sector with over $2 billion under management. It has held a 28% shareholding in the UK oil and gas exploration company Igas Energy since a refinancing deal in 2017 that saw Kerogen inject US$35million of fresh funds into the firm via its Unconventional Energy Limited vehicle alongside IGas' debt-for-equity deal with its lenders to help ease its financial pressure and debt burden.[32]Igas non-executive board member Philip Jackson serves on Kerogen’s Investment Committee. [33]

- KKR owns 14.7% of IGas through KOG Investments S.A.R.L. KKR executive Hans Arsted - sits on Igas Energy's non-executive board as part of KKR's rights to take up a seat.

Financiers over time

- Barclays, banker

- Ernst & Young, auditor

- MoFo Secretaries Limited, Company Secretary

- Investec Bank plc (NOMAD and Joint Corporate Broker) previously Jefferies Hoare Govett, Nominated Adviser and Broker

- Computershare Investor Services plc, Registrar

- Macquarie Bank Ltd

- Norsk Tillitsmann

- Canaccord Genuity (Joint Corporate Broker) circa 2019, Henry Fitzgerald-O'Connor/James Asensio

Contact

- Address: 7 Down Street,

- London,

- W1J 7AJ

- Telegraph: +44 (0) 207 993 9899

- E-mail: enquiries@igasplc.com

- Website: http://www.igasplc.com/

Resources

- Melissa Jones and Andy Rowell, Access all areas: Westminster's (vast) fracking lobby exposed, 29 April 2015.

- Gas chief Andrew Austin: Fracking in East Midlands could provide 'big prize', BBC News, 7 April 2014, acc 16 April 2014

Notes

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 Unlocking Britain's Energy Potential, IGas Energy plc Annual report and accounts 2013/14, access 20 August 2014

- ↑ 2.0 2.1 BBC News, [http://www.bbc.com/news/uk-england-26910718 Gas chief Andrew Austin: Fracking in East Midlands could provide 'big prize, 7 April 2014

- ↑ IGas Energy plc, Result of Annual General Meeting and IGas approval of the acquisition of Dart, Company press release, 1 September 2014.

- ↑ Daniel Mason,‘It just shouldn’t be there’: MP condemns fracking site, govtoday.co.uk, 5 February 2014, acc 20 October 2014

- ↑ INEOS to acquire significant share of key IGas North-West shale gas assets, Ineos press release, 10 March 2015, accessed same day

- ↑ Ruth Hayhurst, Picture post: IGas announces spud of Tinker Lane shale gas well after 80+ hour protest, DrillorDrop, 27 November 2018.

- ↑ IGas Energy, Operational Update - Tinker Lane and Springs Road, 15 February 2019

- ↑ Tinker Lane, IGas 2018 FY Results, 28 March 2019, accessed 20 June 2019

- ↑ [http://www.lse.co.uk/share-regulatory-news.asp?shareprice=IGAS&ArticleCode=x2tv5xiw&ArticleHeadline=Springs_Road_SR01_Shale_Exploration_Well_Results Regulatory News for Igas Energy (IGAS) Springs Road SR-01 Shale Exploration Well Results, 27 Jun 2019 07:00, accessed same day

- ↑ What do they Know?, Shale Gas Round Table: internal review of Freedom of Information request to Department for Business, Energy and Industrial Strategy, 24 July 2018

- ↑ Ruth Hayhurst, What government told the shale gas industry about success, regulation, jobs and support, Drill or Drop, 22 October 2018, accessed same day.

- ↑ Igas Energy, 'Warning High Court Injunction in place, Igas PLC website, 3 September 2018

- ↑ David Holmes, IGas injunction renewed to stop direct action by Ellesmere Port activists, Cheshire Live, 19 December 2018

- ↑ Ruth Hayhurst, £900,000 bill for Notts shale gas policing, Drill or Drop, 3 June 2019, accessed 14 June

- ↑ Councillors reject fracking firm's plan to test for shale gas in Ellesmere Port, CheshireLive, 25 January 2018

- ↑ Ruth Hayhurst, IGas exploration plans are “in the heart of a community”, Ellesmere Port campaigners warn, DrillorDrop, 10 December 2018

- ↑ Ruth Hayhurst, Campaigners to argue that IGas Ellesmere Port gas test is a risk to public health, DrillorDrop, 8 January 2019, accessed 23 February 2019

- ↑ Ruth Hayhurst Ellesmere Port inquiry decision delayed over climate change report, DrillorDrop, 18 June 2019

- ↑ IGas Energy PLC, Annual report and accounts 2012/13

- ↑ Production, Igas, acc 16 April 2014

- ↑ Tinker Lane CLG Meeting 7th February 2019: Restoration, accessed 22 February 2019

- ↑ 22.0 22.1 22.2 22.3 22.4 22.5 About Us, IGas website, undated, acc 16 April 2014

- ↑ RNS Number : 0807N Igas Energy PLC, released 23 July 2014

- ↑ Ian Lyall, IGas chief tops up his holding, Proactive Investors, January 17, 2014

- ↑ Proactive Investors, Gas Energy Plc RNS Release Board Appointment, 21 May 2019, accessed 28 June 2019

- ↑ Giles Gwinnett, IGas Energy welcomes Robin Pinchbeck as director, July 11 2012

- ↑ Register of All-Party Groups (As at 7 June 2013), parliament.co.uk

- ↑ Register Of All-Party Groups [as at 18 August 2014, acc 19 August 2014

- ↑ APPC Register Register for 1st March 2014 - 31st May 2014, acc 25 June 2014

- ↑ APPC Register Register for 1st March 2014 - 31st May 2014, acc 25 June 2014

- ↑ Public Relations Consultants Association. PRCA Public Affairs Register Entry, 1 Jun - 31 Aug 2011

- ↑ Proactive Investor, Kerogen Capital ends up with near 28% shareholding in iGas Energy following completion of its recent refinancing, 06 Apr 2017, accessed 28 June 2019

- ↑ IGas Energy plc IGas Energy board of directors, IGas website, page last accessed 28 June 2019